How to Pick a Recurring Billing and Payment Provider

When it comes to subscription management and recurring billing for web apps, it can be a bit overwhelming to track down what it all means. We’ve decided to come to the rescue with our beginner’s guide to subscriptions, payment gateways, merchant accounts, and the companies that provide them.

What is a Payment Gateway?

Payment Gateways are the backbone of online payments and e-commerce of all kinds. If someone is taking your credit card online, they are probably using a payment gateway. It is these guys that connect to all the credit card companies like VISA, Mastercard and AMEX to make it easy to collect any kind of credit card you want without having to submit to Payment Card Industry (PCI) compliance.

What is a Merchant Account?

Once a credit card is charged, the money needs to go somewhere. That’s where a merchant account comes in. A merchant account is a type of bank account that allows businesses to accept money from payment cards. If you want to accept credit cards online, you will need a merchant account. You might not realize this because some payment gateways will provide you with a merchant account behind the scenes, but there will always be a merchant account in the mix.

What is a Recurring Billing service?

Charging someone’s credit card and making sure that the money ends up in your account is what Payment Gateways and Merchant Accounts are all about, but what about handling a subscription that needs to get charged every month? That’s where the subscription and recurring billing systems come in. These services have a credit card vault, and a list of recurring charges, and it’s their job to make sure that every month the right people get charged the right amount.

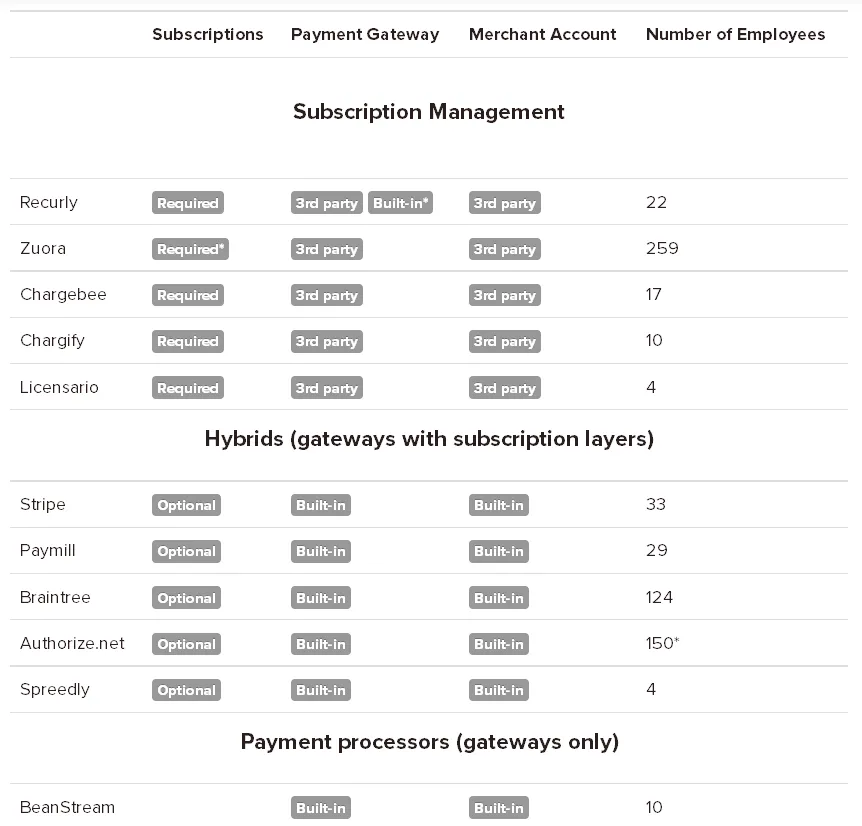

Some services, like Recurly, focus entirely on this problem, and were built on top of other payment gateways and merchant accounts. Meanwhile, payment gateways have evolved and launched simple recurring billing modules on top of their payment gateways.

While some payment gateways have existed for decades, the recurring billing space is not nearly as old. The companies that focus on recurring billing as their core have developed a bunch of features to make your life as a software developer easier, such as sending emails to your customers with their invoices, pro-rating upgrades and downgrades, and managing dunning (i.e. handling when a credit card has expired or rejected a charge).

So, How do I pick?

Here are three questions that will help you narrow down your search.

Question 1 – What do your payments look like?

Are you doing simple plan-based billing, or are you going to be charging for variable usage? If you’re building something complicated, then you probably want to look at a company that focuses on SaaS as their primary business instead of a “Hybrid” payment gateway. If you’re doing simple plan-based billing, then you’ll be pleasantly surprised at how quick and easy it can be to configure some of the Hybrid gateways to do just that.

Question 2 – Where are you?

Some providers are only available in a select few countries. For example, Stripe is only available in the USA and Canada, while others, such as Paymill, focus on the European market. Payment processing law is a complicated, region-dependent beast, so you want to make sure that you have the right mix of payment gateway and management layer to help you navigate the legal maze for where your company is headquartered.

Question 3 – How much can you spend?

Most hybrid gateways don’t charge extra for their subscription layer. That’s great news if you’re doing something simple, but if you need the power of the subscription-focused services, you’re going to have to pay extra. Most companies have a mix of monthly fee plus transaction fee, and don’t charge anything to get started. That said, there are some companies, like Zuora, that charge a five-figure price tag to get set up and don’t work with companies under $1M in yearly revenue.

Finally

If you still have multiple options after you answer these questions, then try a game — post a support request or a tweet and see which providers gets back to you the quickest. If that still doesn’t help, then take a look the API documentation and pick the one with the cleanest and easiest to use API. At the end of the day, you need to make sure that you trust your provider to be easy to use, give good support, and grow along with you.