10 Referral Programs That Are Shaking Up the Finance Industry

In order to acquire, retain and improve customer experience, referral programs are estimated to be in use with as many as 30% of all North American financial institutions. Since the bottom line is top of mind for every company involved in financial services, it’s no wonder that most successful companies have chosen to take advantage of referral marketing.

The reason why is a matter of numbers. When 92% of consumers trust recommendations from friends and family more than a brand message, referrals become increasingly important when it comes to trusting an organization with one's hard-earned money. If financial groups can ensure that the cost of acquisition (referral reward) is lower than the lifetime value generated by the customer, a referral program becomes an extremely worthwhile strategy.

Despite being an industry typically known for its legal jargon and tedious fine print, financial brands are proving that your referral marketing doesn't have to be boring. Read on for ten examples of referral programs financial services use to showcase their brand personality and change the way they acquire and keep top customers. We’ll show you the structure of each program, what we like about it, and tips you can apply to your own referral program.

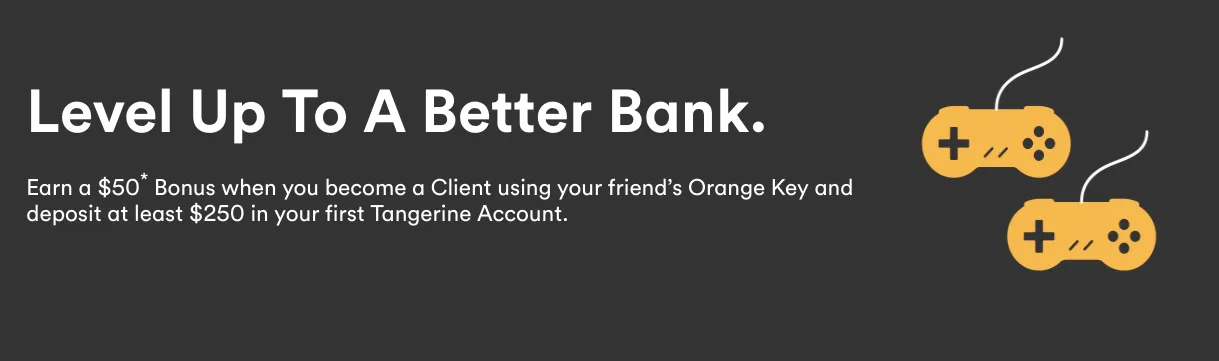

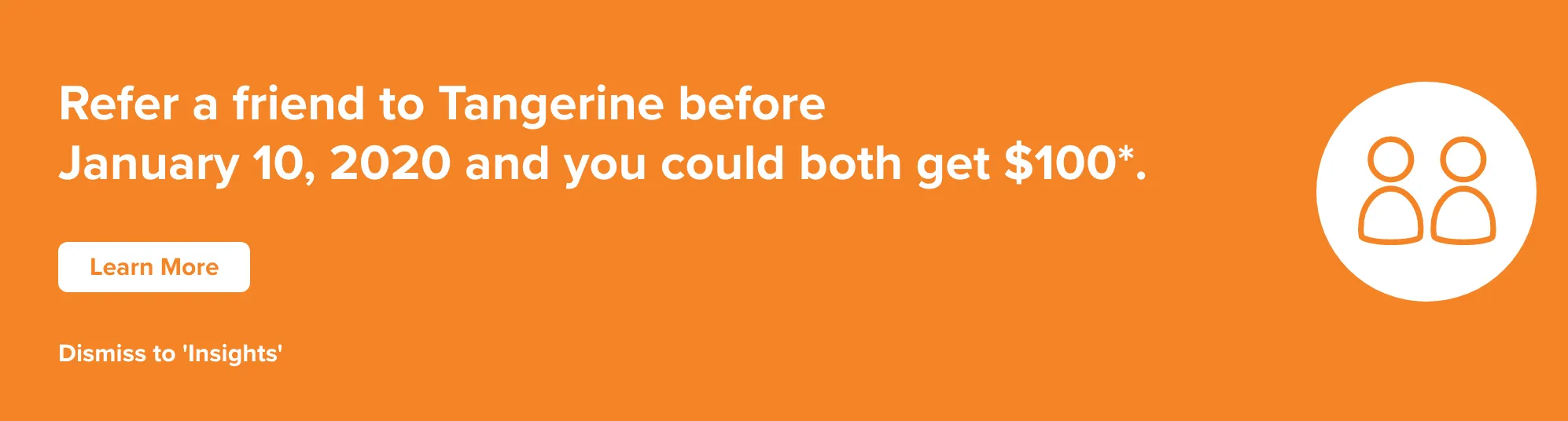

1 - Tangerine Bank

As a purely online banking platform, Tangerine has been a leader in modern customer engagement, with its referral program at the forefront of its growth strategy.

Referral Program Setup: New clients earn $50 when they open a Tangerine account with a friend’s Orange Key (referral code) and deposit $250.

Tangerine is also known to offer limited-time referral bonuses with more substantial rewards to drive immediate customer action:

What we like about it:

- The messaging is direct and clearly outlines the offer for both parties. Clarity and transparency are key aspects in the financial realm and Tangerine does well to transmit the whole picture right away so visitors feel secure and open to inviting their friends.

- As we’ll notice throughout these examples, user activation is key for financial institutions to acquire and keep new customers, which makes it smart to have the referral reward dependent on a deposit into the new user’s account first.

- A $50 cash bonus is a worthwhile reward for the average customer, and it’s easy for Tangerine to deliver straight into user’s accounts.

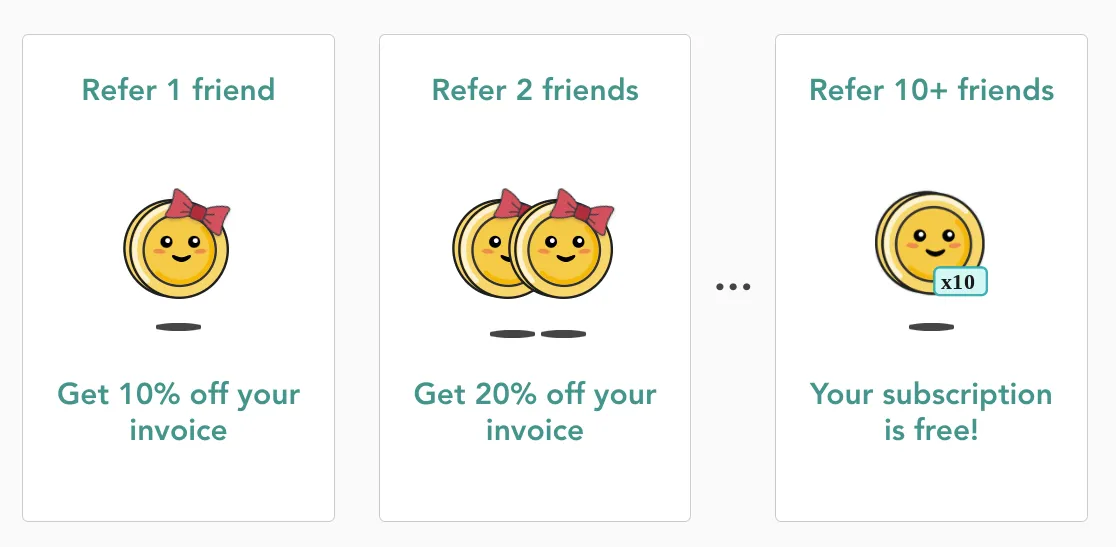

2 - Lunch Money

Lunch Money is a budgeting and financial management app that uniquely includes support for multiple currencies, automatic currency conversions, and cryptocurrency portfolios.

Referral Program Setup: Referring friends to Lunch Money earns you a 10% stackable discount on your monthly invoice, while your friend receives a free month after their trial. If you refer more than 10 friends, your bill is $0 and you’ll also get a special gift.

What we like about it:

- Offering stackable discounts with each referral is a great way to increase customer retention. A user is much less likely to consider switching to a competitor if it means they'll need to give up the monthly discount that they’ve earned.

- The goal of a completely free subscription is an excellent motivator to keep sharing the app with friends - especially when the app’s users are clearly in the process of trying to save money!

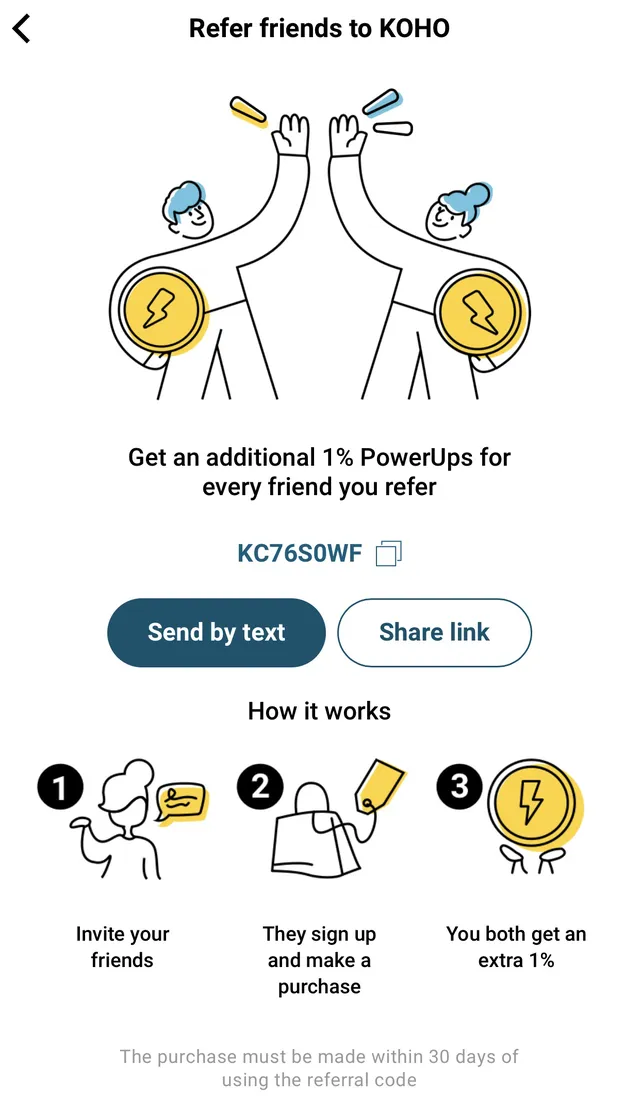

3 - KOHO

KOHO offers a way to manage your spending and saving habits similar to a checking account, but with the added perks of a credit card. Simply load money onto your KOHO card, and receive cash back on purchases. KOHO cards are reloadable prepaid Visa cards, so you can use it just like a credit card when it’s really a debit card with cash back.

Referral Program Setup: Refer a friend to KOHO and you’ll each earn 1% extra PowerUps on every purchase for 90 days. You can refer up to 10 friends to KOHO, which translates to up to 10% in PowerUps.

PowerUps are the percentage of cashback you get from purchases using KOHO, and without referrals, sit at a baseline of 0.5% on whatever you spend.

What we like about it:

- The reward of increased cash back is directly related to the reason people sign up for KOHO in the first place, which is to earn more from everyday spending.

- You can only refer up to 10 friends to KOHO, and once a friend signs up, they will permanently hold one of your 10 referral slots. While this may seem limiting, this actually prompts users to really consider who they want to refer for the best chances of a conversion. This increases the user’s chance of earning more cash back, and increases KOHO’s chances of acquiring high-quality customers.

4 - Western Union

The phrase "[Amazon.com/gc-legal](http://amazon.com/gc-legal)" is also hyperlinked in blue font. In the center of the image, there are white numbers "1", “2”, and "3" with a yellow circle background and a silhouette of golden color. There are three steps: 1. Log in or sign up on [WU.com](http://wu.com/) or via the mobile app and invite up to 25 friends to send money with Western Union. The phrases "[WU.com](http://wu.com/)" and "mobile app" are hyperlinked. 2. Your friend must create a profile and send $100 or more. The phrase "create a profile" is hyperlinked. 3. Enjoy a $20 [Amazon.com](http://amazon.com/) e-gift code after your friends successfully send money. There is an asterisk next to the word "code."](https://www.saasquatch.com/wp-content/uploads/2016/08/western-union-referral.png)

Western Union provides a convenient and reliable way to transfer money across the globe. Users can send money online, via the app, or in person at an agent location.

Referral Program Setup: When you invite a friend to Western Union and they send $100 or more through WU, the referring user receives a $20 Amazon gift card. You can invite up to 25 friends for an earning potential of $500.

What we like about it:

- The program description highlights the earning potential of $500 in gift cards, giving customers a goal to work towards, while the three steps to earning are easy to understand and execute.

- While many financial apps offer straight cash as rewards, gift cards are an excellent alternative as they can be easy to manage, track, and send if the platform doesn’t necessarily have access to a user’s bank accounts.

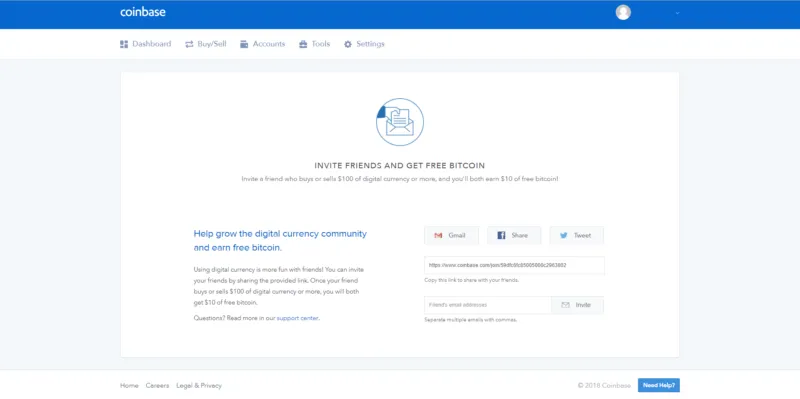

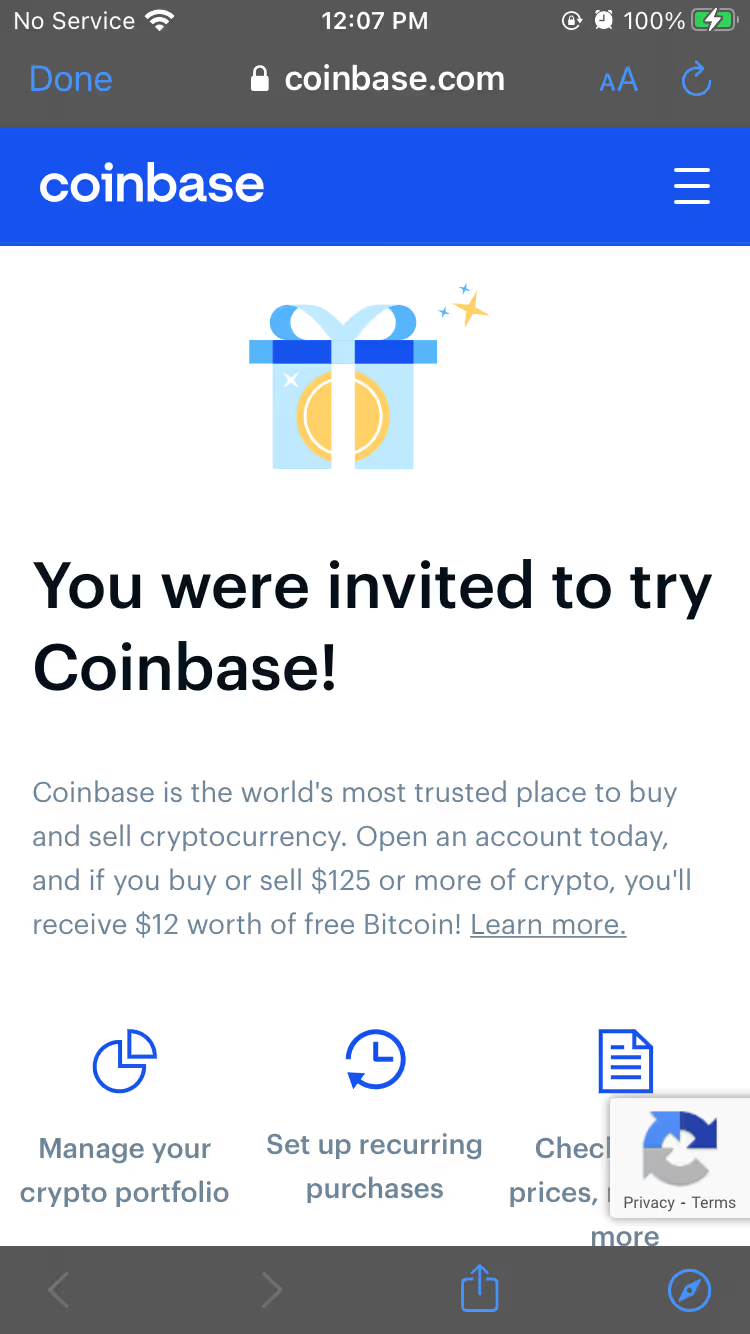

5 - Coinbase

Coinbase is a cryptocurrency trading platform that makes it easy for anyone to start buying or selling crypto. With over 56 million verified users, Coinbase offers an intuitive platform as well as educational resources to make the most of your trading experience.

Referral Program Setup: Existing Coinbase users can earn $10 worth of Bitcoin (BTC) when a referred friend completes either a buy or sell order amounting to at least $100 worth of Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH) or Litecoin (LTC) within 180 days of creating their account.

The referred friend also receives $10 worth of Bitcoin once the conditions are met.

(CAD version pictured above)

What we like about it:

- Coinbase offers a reward directly relevant to their user base which encourages more trading and time spent within the platform.

- Making the reward conditional upon an in-app transaction by the referred friend is an excellent way to drive new user activation. Plus, it encourages discussion between the referring user and their friend to share knowledge and experience, creating a trustworthy onboarding experience.

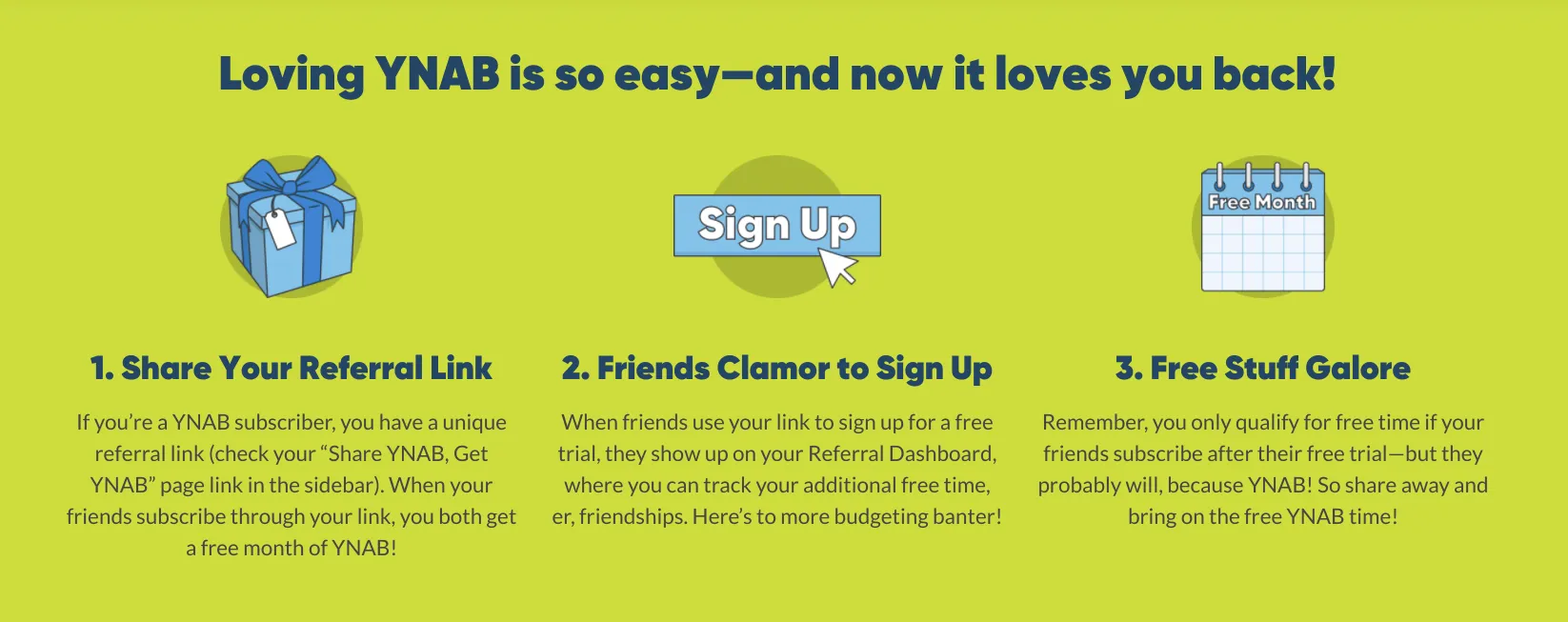

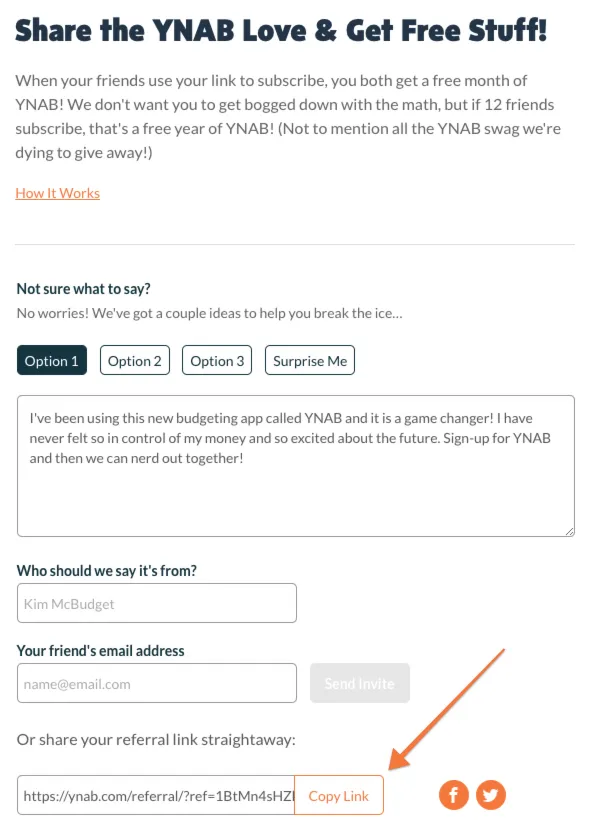

6 - YNAB (You Need A Budget)

YNAB (You Need A Budget) is a budgeting app that helps its users get out of debt and take control of their finances. It teaches users how to manage their money and start spending wisely to set themselves up for success.

Referral Program Setup: Refer a friend to YNAB and receive a free month’s subscription. Referred friends also receive a free month once they subscribe to YNAB.

What we like about it:

- As an app centered around saving money, it’s a no-brainer that referring friends should earn you some cost savings. Plus, while users are working within the app, they’ll be in the mindset of finding ways to lower their expenses, and more likely to jump at the opportunity to save on their subscription.

The reward of a free month also breaks down the barrier to entry for new users, who, considering they are trying out budgeting software, don’t want to spend more than they have to.

- While money and finances are often a serious topic, YNAB find ways to add personality to their referral program, such as by providing a fun and interactive way to select which share message you will use to invite friends:

7 - PensionBee

PensionBee is an online pension provider that lets users combine all of their pensions into one brand new plan that they can manage like their bank account, with one clear balance and the ability to make contributions at any time through its website or mobile app.

Referral Program Setup: PensionBee rewards referring users and their friends with £50 added to each of their pensions, when the referred friend transfers a pension to the app.

What we like about it:

- With the referral reward dependent on the friend transferring a pension to PensionBee, this greatly increases the chances of a successful new user activation. Plus, the referring user will be more willing to motivate their friend to finish setting up their account in order to receive their reward.

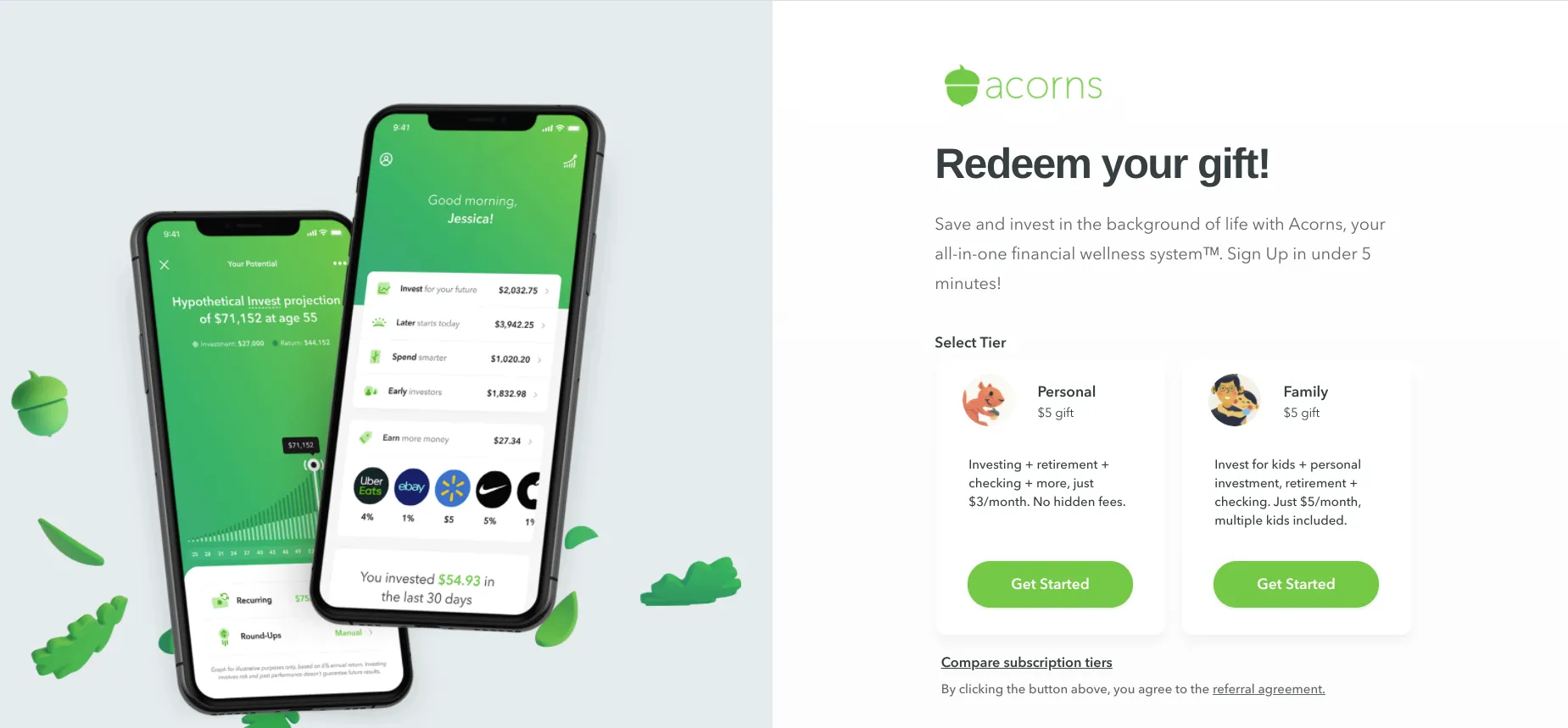

8 - Acorns

Acorns is a wealth management platform that specializes in micro-investing. Acorns makes it easy for anyone to start saving for the future with investment, retirement, and checking features all in one app.

Referral Program Setup: When you refer a friend to Acorns and they sign up with your link, you’re both rewarded with $5 deposited in your Acorns Invest account.

What we like about it:

- While a referral bonus of $5 may not seem like much, Acorns is known to significantly increase the reward with limited-time offers on what appears to be a weekly basis. Depending on the week, rewards range from $100 to $1,000 for a specific number of referrals, often 3 or 4.

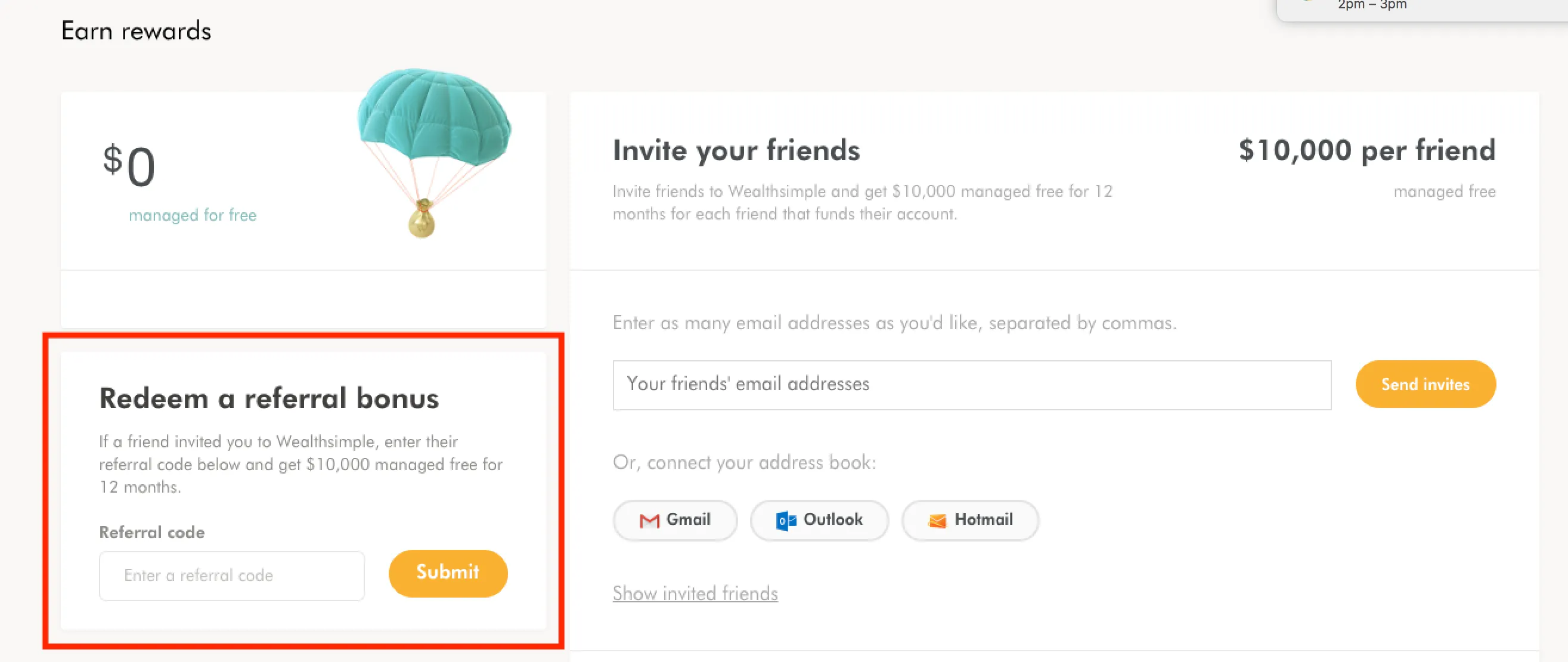

9 - Wealthsimple

Wealthsimple is an online investment management service offering financial tools and expert advice. The platform helps users build smart portfolios with guidance on how to achieve their financial goals.

Referral Program Setup: Wealthsimple clients can invite friends to earn $10,000 in assets managed for free for 12 months, when their friend joins and funds an account. The referred friend also receives $10,000 in assets managed for free for 12 months.

What we like about it:

- Offering $10,000 in managed assets is a unique reward that not only saves users the normal management fee, but gets them more involved in the app. The referred friend will be more likely to explore Wealthsimple’s offerings if they can do so at a reduced cost.

- Wealthsimple is also known to run contests where each referral counts as an entry to win a cash prize (such as for $10,000), which is a smart strategy to diversify rewards and promote timely referrals.

10 - Robinhood

Robinhood is a commission-free stock trading and investing app that features cash management accounts, cryptocurrency trading, and no account minimums.

Referral Program Setup: When inviting users, Robinhood customers can earn a free stock for them and their friend. The stock (valued anywhere between $3 and $225) is delivered once the referred friend links their bank account.

What we like about it:

- Robinhood does a good job of promoting their program with the concise tagline of “Invite Friends, Get Stock”.

- The stock reward that a user receives remains a surprise until it’s added to their account, which adds an extra level of excitement when making a referral. However, to manage expectations, Robinhood is quick to note in their FAQ that approximately 98% of the participants will receive a reward stock having a value from $2.50 to $10.

Quick tips for a customer referral program in the financial industry:

Keep the offer clear

Financial websites and apps are known to require a significant amount of fine print that can’t be overlooked. Despite this, referral programs are meant to be inviting and intuitive for customers. Make sure you’re providing the necessary details in a way that isn’t overwhelming, but remains accessible to those needing clarification.

Offer a relevant reward

All of our examples demonstrate how the ideal reward is one relevant to your customers and their needs. In many industries, cash can be a tricky reward to offer logistically, but when you’re already set up with each user’s banking details, it can serve as an excellent motivator.

Attract the right kinds of customers

Conditions and rules on a referral program might sound limiting, but we’ve seen how they can help you attract high-quality customers who are more likely to stick around. For example, KOHO limits the amount of referrals you can make while still providing a worthwhile reward, which ensures its users will carefully consider who they refer.

Consider a double-sided offer

Many of our examples made use of a double-sided referral offer, meaning that both the referring customer and the referred friend earned a reward. This helps create motivation for both the initiation and the completion of the referral, which is crucial considering the amount of options customers have to choose from when looking for a new bank or budgeting software.

Don’t be afraid to add personality

In an industry otherwise known for technical language and boring terms and conditions, your referral program presents an opportunity to showcase your brand’s personality through your messaging, images, and user experience.

Summing Up

This wraps up our list of just a few financial companies using referral programs to grow their customer base, motivate people to complete their account setup, and increase customer revenue.

As more financial apps and services move online and go mobile, there are even more opportunities to engage users and attract new ones with the right offer.

What are your favorite referral programs in the financial industry? Let us know by tweeting us!