Loyalty ROI: What do your acquisition rewards cost?

There are two common reasons why customer loyalty strategies fail.

Either the customers don’t see enough value in participating…

Xbox Live Rewards just sent me 20 Microsoft points as a “birthday gift.” That’s $.25.

— Matt Clark🌹 (@ClarkMatt) March 5, 2013

…or the company can’t financially sustain the program.

The Tesla customer referral program will end on Feb 1. If you want to refer a friend to buy a Tesla & give them 6 months of free Supercharging, please do so before then.

— Elon Musk (@elonmusk) January 17, 2019

A marginal incentive keeps your profit high but makes your customers feel unappreciated, while high-value rewards may quickly drive sales but eventually hurt your bottom line.

In both cases, customer loyalty is negatively impacted.

As a digital marketer, having the right knowledge to measure the sustainability of your loyalty rewards program can mean the difference between delighting and disappointing your customers.

How do you choose rewards that are substantial enough to motivate customers, but won’t break the bank?

All you need are a few (simple) formulas.

Learning to calculate the return on investment (ROI) of your rewards structure is the best place to start. This means figuring out if the revenue (return) you make from acquiring new customers with rewards is enough to justify the cost (investment) of the incentives you offer.

Before launching your loyalty rewards program, take the time to measure your customer’s desires against your company’s financial situation so you aren’t forced to pull the plug on incentives down the road.

You can evaluate the three main stages of the customer loyalty journey where your ROI may be calculated differently:

- Acquisition: Rewarding new users to engage with your product or service for the first time (ie. Referral Programs, Welcome Offers)

- Revenue Generation: Rewarding customers to keep contributing to revenue (ie. loyalty programs, Flash Sales)

- Re-activation: Rewarding churned customers to re-engage with your product or service (ie. Win Back Programs, Monthly-to-Annual Offers)

In this article, we’re focusing on calculating financially sustainable loyalty offers at the first stage: acquisition. We’ll dig into the financials at the other two stages in later articles.

Acquisition offers include referral rewards, first-time-purchase offers, regional offers, or any special incentive to engage a brand new customer with your product or service.

After reading our previous post about choosing the right rewards for your loyalty program, you may have a few ideas in mind. But do you know exactly how much you can afford to offer?

If you haven’t read the previous post, we suggest you go back and give it a read now.

Return on Investment (ROI)

Many companies never calculate the Return on Investment of their customer loyalty program and therefore have no idea if their program is hurting or helping their bottom line.

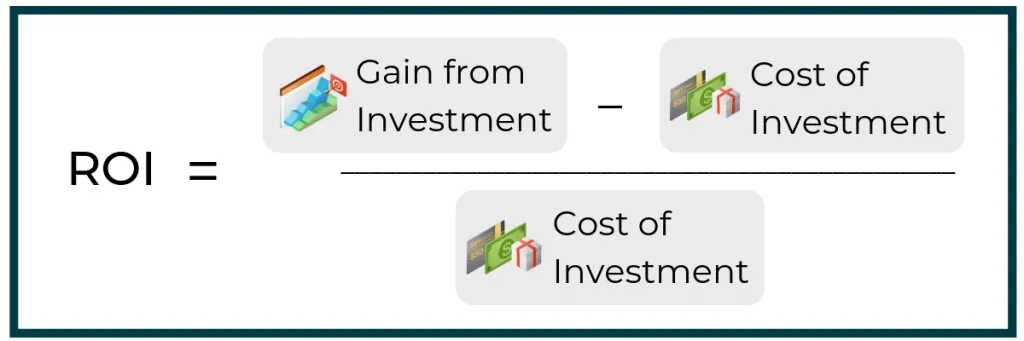

ROI is designed to measure the benefits you gain (ie. more revenue) as a result of a certain investment you make (ie. marketing and acquisition costs).

To calculate ROI of your customer acquisition rewards program you need to know three values:

- Lifetime value of a customer

- Dollar value of your rewards

- Cost to acquire a new customer

Generally speaking:

As a basic rule, your loyalty program should ensure the lifetime value of a customer exceeds the cost needed to acquire them.

Let’s walk through how to obtain the values for your ROI calculation.

1. Lifetime Value of a Customer

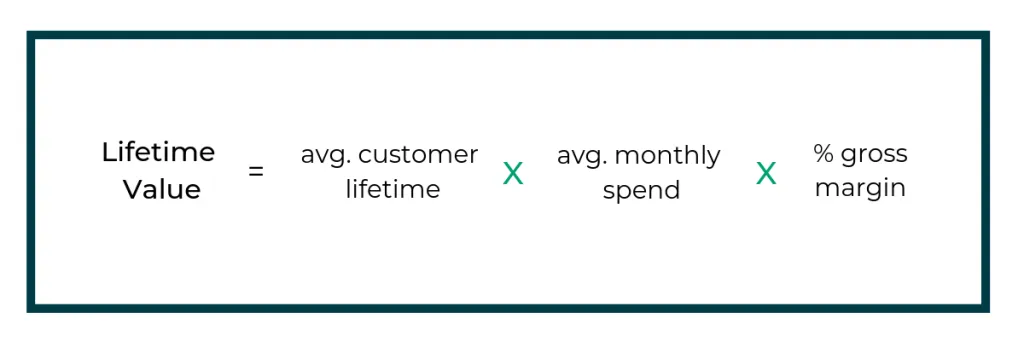

Customer lifetime value (LTV) is a measurement of how much you will earn from an average customer over their lifetime using your product.

For SaaS companies, the LTV formula typically looks like this:

Let’s assume:

- 24 month average lifetime*

- Average monthly plan of $50/month

- Gross margin of 60% (to account for only the revenue earned after cost of goods sold)

LTV = (24 * $50) * 60% = $720

Tip: To make this number more accurately reflect the impact of referrals, multiply your result by 1.25. Why? A study from the University of Pennsylvania’s Wharton School of Business found that referred customers generated 25% higher profit margins and higher lifetime values than customers acquired through other channels.

*For the purposes of this article, our LTV calculation will use a customer’s revenue only until they churn, and not after they are re-activated.

2. Reward Dollar Value

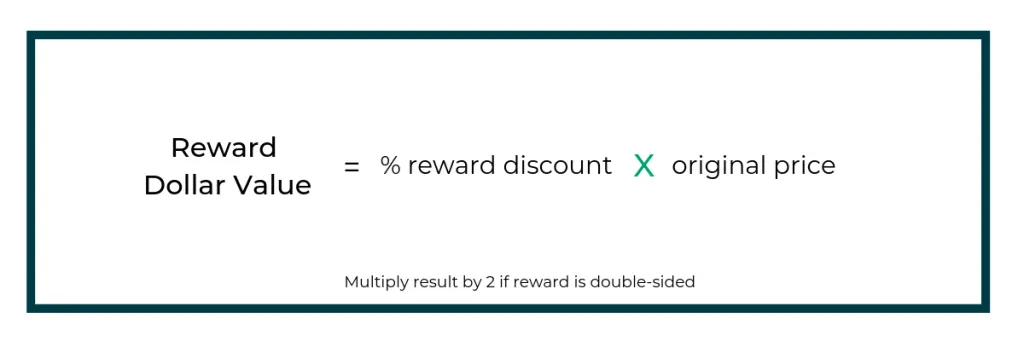

No matter what you decide to offer as a reward, you need to calculate the actual dollar value cost.

This is especially important if you are giving away something without a direct monetary value such as feature upgrades, free shipping, or a free consultation with one of your in-house experts. These rewards may actually cost you much less than their worth as perceived by the customer.

Here’s a typical formula that can be applied to subscription discounts or cost savings on single purchases:

Example:

- In a referral program, your reward is 40% off to both the referring user and the referred user for one month of their subscription

- The referring user is on a $50/month plan

- The referred user signs up for the same $50/month plan

Reward $ Value = (40% * $50) * 2 = $40

Note: If the referral reward was one-sided, the calculation would only be (40% * $50) = $20

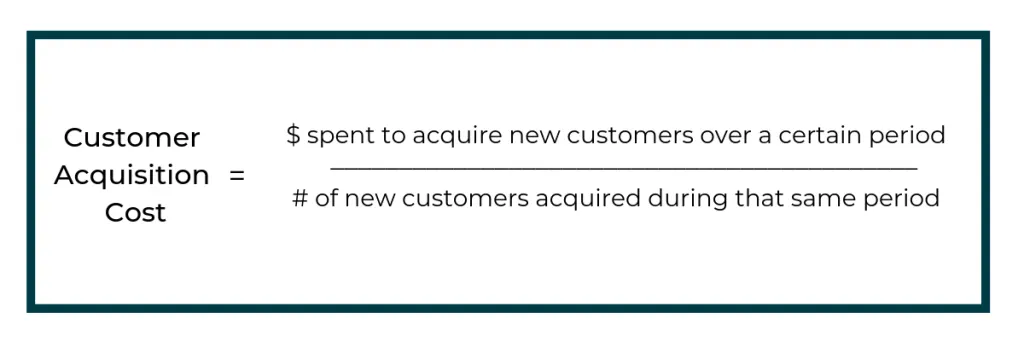

3. New Customer Acquisition Cost (CAC)

CAC is meant to represent the total costs associated with acquiring a new customer. The value of your reward is only a part of this cost.

Other costs included in acquiring a new customer with a loyalty program might include the subscription to loyalty software, or the cost of human resources dedicated to managing your program.

The basic CAC formula looks like this:

Let’s assume that in one month:

- Loyalty software cost: $1000/month

- New customers acquired: 10/month

- Reward value to acquire one customer: $40 (based on the reward value calculated above)

CAC = (($40 * 10) + $1000)/ 10 = $140

Calculating your Return on Investment (ROI)

After calculating the value of your reward, the cost to acquire a new customer, and the lifetime value of a customer, you can now calculate your basic Return on Investment (ROI).

This will help indicate if what you are spending on acquisition rewards can be easily and quickly recovered based on how much a new customer will spend with you in the future.

To calculate your basic ROI, we’ll use the values calculated earlier:

LTV: $720

CAC: $140

ROI = ($720 – $140)/($140) = 4.14

If your ROI is greater than 1, then your reward structure is profitable. This is also expressed as LTV: CAC Ratio in certain industries.

LTV : CAC ratio = 720/140 = 5.14

Your target ratio should be around 3.

An LTV : CAC ratio of great than 5 means you’re likely spending too little to acquire customers and are slowing your growth.

An LTV : CAC ratio of 1 or less means your customer acquisition program is not profitable and will likely cause financial problems.

Experimenting with the value of your rewards will help you maximize your ROI. Keep in mind that a lower reward value can lead to lower customer motivation.

Further considerations to boost ROI

Fraud protection: People will try and skirt around your program’s rules and take advantage of your rewards. Ensure that the software you decide to leverage is equipped with fraud detection so you can control the flow of rewards and maximize revenue per campaign.

Data: Customer data serves as your best indicator for tweaking your reward structure to maximize benefits for both you and your customers. Improve your ROI with customer segmentation, automatic reward redemption, and reports to track program effectiveness.

Other Rewards: Remember that not all great rewards need to have an explicit monetary value (ie. $ or %). It all comes down to what will motivate your customers, and this might be free swag, free consultations, or access to new features. Although these rewards may cost you less upfront, make sure you take into account any associated costs in the calculations above.

Check back soon for more guidance on choosing the best rewards for your loyalty program.