Loss Aversion: How FOMO Drives Customer Action

Why is it that we just can’t seem to toss out that shirt in our closet we never wear? What about the book on our shelf we’ll never read?

It’s because we’re wired to avoid loss. We don’t want to experience unpleasant emotions like grief and pain that come from losing or missing out on something.

In modern-day terms, this is referred to as FOMO (fear of missing out), which is especially prevalent when we see friends broadcasting their life experiences on social media.

In marketing, this cognitive bias is known as loss aversion and is a popular tactic used to trigger impulse buys and reduce a customer’s decision time. When there’s an extreme sale ending in two hours, we want to buy right away to avoid the negative feelings of missing out.

Loss aversion can be a powerful tool to apply to your loyalty strategies to increase conversions and grow your business.

Keep reading to learn how using loss aversion can completely change how users interact with your loyalty program.

What is loss aversion?

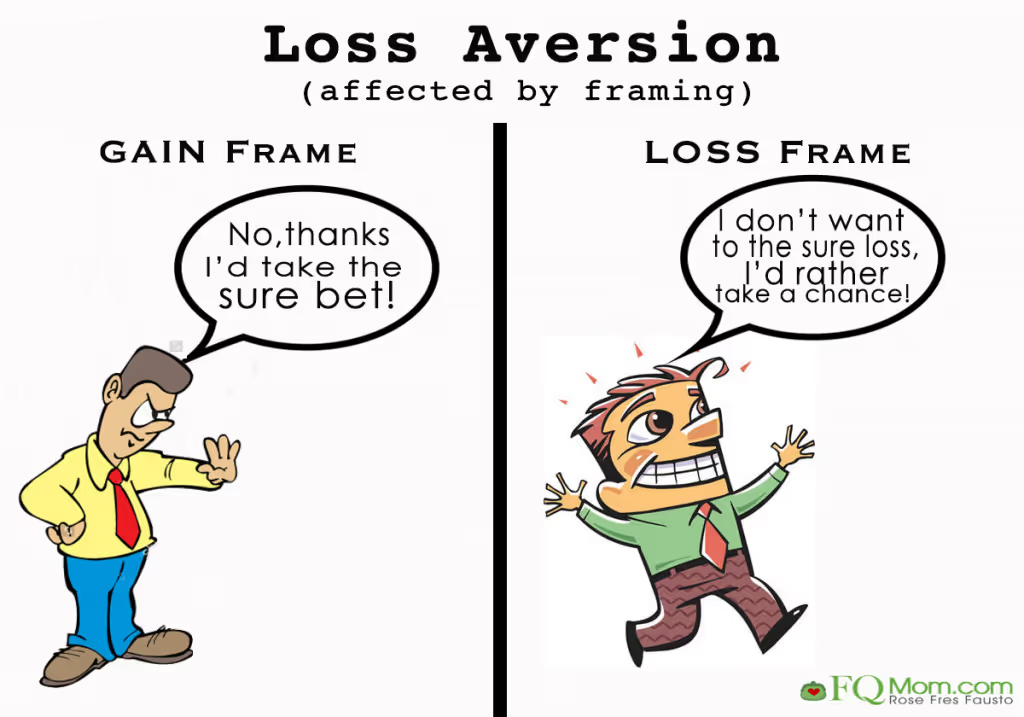

Loss aversion is the psychological principle that says the pain we feel from losing something is far greater than the positive emotions we feel from gaining it.

It’s even been found that the pain we feel from loss is about twice as powerful as the pleasure of gaining.

Put simply, we’re more upset to lose $10 than we are happy to find $10.

As you’ll learn from the studies and experiments summarized below, we’re more willing to take risks and display irrational behavior in order to avoid loss.

This can be seen in all facets of our lives: At home, it’s why we can’t throw out that shirt we’ll never wear, or why we don’t cancel the gym membership that we’re not using. Professionally, it’s why people stay in a job that no longer makes them happy.

It’s understandable that we want to avoid the negative feelings associated with losing something, and will alter our behavior to do just that.

Loss aversion in marketing

By knowing that humans will adjust their behavior to avoid negative emotions, loss aversion is often leveraged in marketing as a way to trigger an immediate response from buyers.

It’s why almost every website advertises a sale that’s “ending soon” (even if it’s not), so that you make the purchase today rather than in three weeks.

The goal of loss aversion in marketing is not to always be taking things away from customers, or threatening to do so. As outlined in an article on Braze, successfully using loss aversion in your marketing means understanding exactly what your customers are afraid of losing and why, and providing them with a solution to avoid this loss.

Often, the ideal customer responses are triggered by simply reframing your language to suggest the possibility of missing out on something.

Let’s explore some experiments that prove the impact of loss aversion.

Loss Aversion Experiments: What is the impact?

Experiment 1: Gain VS Loss

In one study, each participant was given $50.

In the first round, participants had two choices:

Option 1: Keep $30 of it

Option 2: Gamble with a 50/50 chance of keeping or losing the entire $50

Result: The majority of participants chose Option 1 to avoid the risk of losing money, Only 43% chose the gamble.

In the second round, participants with the $50 had two choices that were primarily framed to suggest loss instead of gain:

Option 1: Lose $20 of it

Option 2: Gamble with a 50/50 chance of keeping or losing the entire $50

Result: The majority of participants (63%) chose to gamble instead of choosing to “lose” money.

Option 1 in both scenarios is mathematically identical – the participant still ends up with $30 in total. However, by framing the choice to suggest a loss instead of a gain, more participants were willing to gamble the money to avoid facing loss.

Read the full article here as it appears in a 2006 issue of Science Mag.

Experiment 2: Survival VS Death

A group of participants were asked to imagine that the US is preparing for the outbreak of a fatal disease, which is expected to kill 600 people. Two alternative programs were proposed to combat the outbreak.

The first group of participants had two program options to choose from:

Program A: If adopted, 200 people will be saved

Program B: If adopted, there’s ⅓ probability that 600 people will be saved, and ⅔ probability that no one will be saved.

Result: The majority of participants (72%) chose Program A, indicating an aversion to risk and loss. The idea of guaranteeing to save 200 people is more attractive than a risky option.

The second group of participants were given two other program options that were framed in terms of death rather than survival:

Program C: If adopted, 400 people will die

Program D: If adopted, there’s a ⅓ chance that nobody will die, and a ⅔ chance that 600 people will die.

Result: The majority of participants (78%) chose Program D, once again indicating a willingness to avoid the guaranteed loss of 400 people.

Just like the first experiment with $50, the two sets of program options yield identical outcomes, yet are presented with different language.

In this case, Programs A and B would save the same amount of people, yet participants were more willing to gamble instead of choosing to lose, displaying a shift from risk aversion to risk taking.

You can read the full study here.

Using Loss Aversion in Loyalty Programs

From the experiments outlined above, it’s pretty clear that people will alter their behavior to avoid loss. How can you leverage this to drive conversions and engagement in your loyalty programs?

This means presenting rewards and special offers in a way that motivates customers to take action now, rather than in two months or two years. By creating a sense of urgency, or suggesting the potential for loss, you drive action faster and more often.

When you use incentives to motivate action, you’re making sure that customers aren’t just avoiding loss, but gaining something in return.

Here are specific ways you can leverage loss aversion to optimize your loyalty programs.

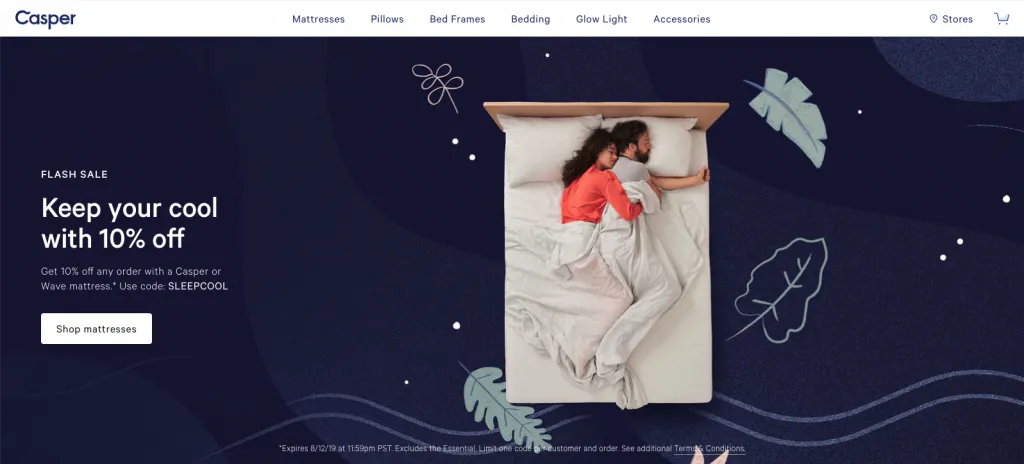

Advertise limited time offers

The most common way of leveraging loss aversion in marketing is through limited time offers like flash sales or countdowns.

The idea is to make the customer feel like they’re missing out on something if they were to wait buy later, and it works: Flash sales are known to generate a 35% lift in transaction rates.

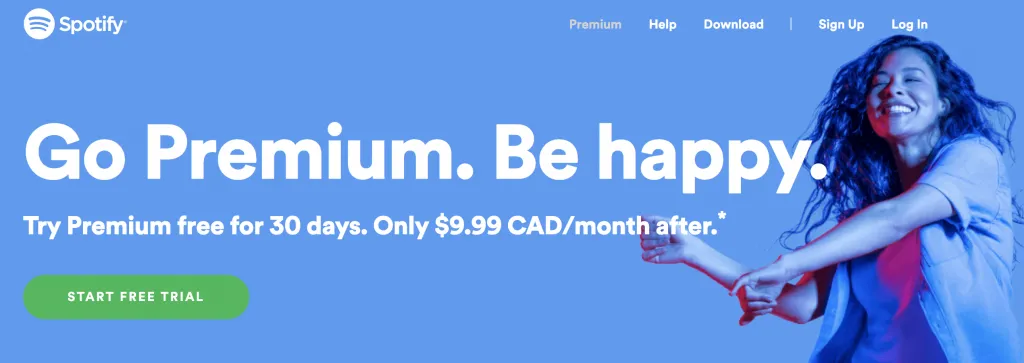

Time-sensitive offers can motivate many customer segments such as those who haven’t bought in a while, or those who are debating upgrading to a paid plan.

Here are a few examples:

– Offer a 10% credit to anyone who places an order within the next 24 hours

– Offer a 25% price reduction on paid plans to those who upgrade before their free trial runs out

– Send a $5 credit to any customer who refers a friend within the next week

Set expiring rewards and redemption periods

Setting expiry dates on reward redemption instills a sense of urgency to motivate engagement from loyalty program members specifically.

The goal of reward expiration is to encourage customers to routinely engage with your brand instead of stockpiling rewards and providing no reason to return to the website.

Similarly to how limited time offers present the potential for missing out, expiring reward periods present a literal risk of loss when customers must “use it or lose it”.

Remember that reward expiry periods are not meant to cause stress, and can easily backfire if not thought through or handled with the customer in mind.

To keep customers happy and engaged, be sure to send ample reminders about upcoming expiry periods, or changes to the redemption structure.

Use customer reviews for FOMO

We typically use the term FOMO (fear of missing out) when it comes to social events or experiences, but this can apply to when people feel like they are missing out by not being a part of your loyalty program or your brand’s community.

As a form of loss aversion, FOMO triggers a person’s fear of “losing out” on experiences, which encourages them to take action. According to StrategyOnline, 60% of millennials will make reactive purchases after experiencing FOMO.

Social proof like customer reviews or influencer programs can be leveraged to drive customer actions. If other people are visibly enjoying and benefitting from your product or service, it’s natural that others will want to do the same.

Putting this into practice, offer an exclusive reward to long-time customers for providing a testimonial, or enter customers into a raffle when they submit a photo/video of them using your product, which you can then share on your website and social channels.

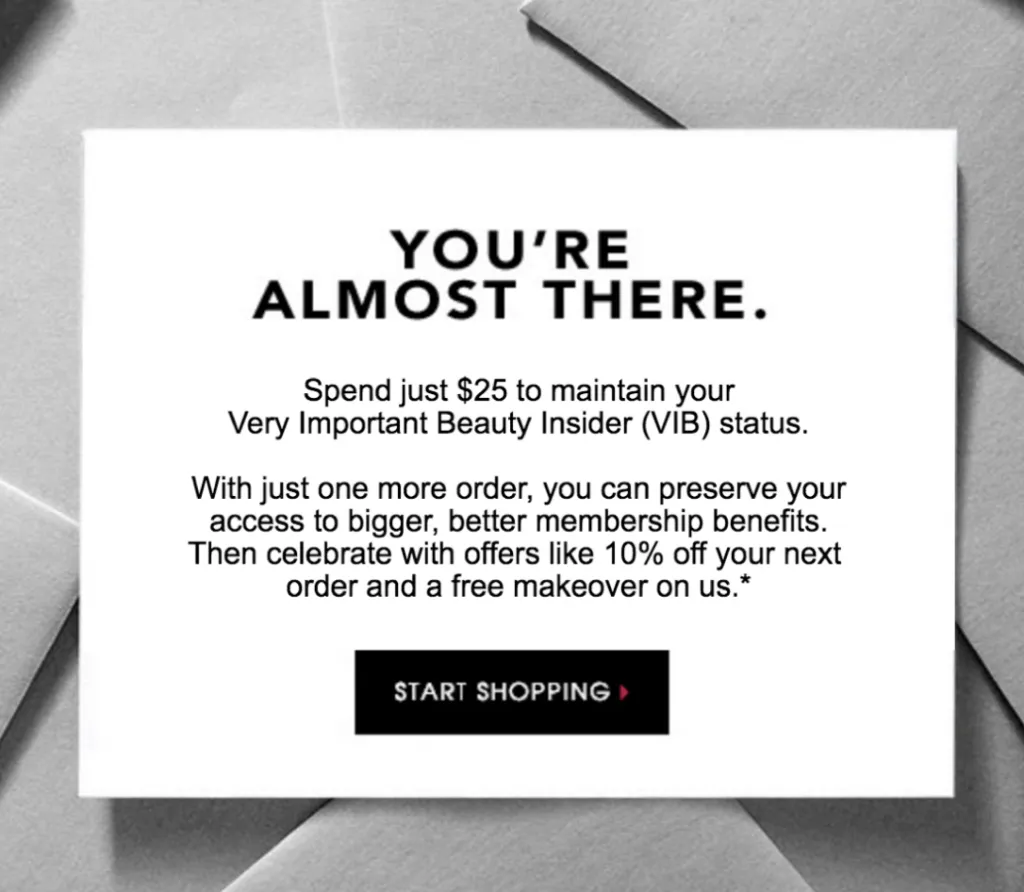

Give customers something to lose

In our previous article about the psychology of loyalty programs, we touched on the endowed progress effect. It says that if customers feel like they are already on their way to achieving a goal (instead of starting from zero), they will be more motivated to reach it.

This is leveraged by giving customers artificial progress like bonus welcome points or three free stamps on a punch card.

By equipping customers with progress right away, whether it be an elevated social status from a VIP tier, or a credit in their reward bank, they’ll be more inclined to stay with your brand in order to avoid losing their progress to-date.

Reward for building a sense of ownership

It’s been proven that the more time and effort we apply to something, the more we value it.

When customers build a sense of ownership around your product or service, its perceived value increases, therefore increasing the aversion to losing it.

Putting this into practice means incentivizing users to perform actions that get them started on the path to ownership, like completing a profile or starting a trial, or placing an order backed by a risk-free trial period.

Think about how mattress companies like Endy and Casper leverage the 100-night risk-free trial. Once customers make the mattress a part of their everyday lives, they become more attached to it, decreasing the likeliness that they will want to “lose” it and return it.

For a digital service, this could mean rewarding users to complete their in-app profile, adjust the default theme with custom colors, or integrate your platform with their favorite third-paty apps, all of which raise their value associated with it.

Customer lifetime value is increased when users become averse to switching to a competitor, as doing so would mean giving up their attachment to your brand and the time they’ve invested in making it their own.

Check out another example below from the online shoe company, Allbirds, which lets customers return their shoes even after wearing them outside.

Final Thoughts

Using loss aversion strategies can be a great way to engage and convert customers, but remember that the goal is not to be evoking fear and stress in your customers at all times.

After too many threats of loss, a customer will not find enjoyment in your loyalty program anymore, generating risk for churn.

We recommend testing individual loss aversion techniques before flipping your entire loyalty program’s structure to suggest loss.

To learn more about designing a loyalty strategy that drives results, enroll in the Digital Loyalty Academy for FREE today!